| When calculating CECL, Edge utilizes the regularly updated Moody’s Expected Consumer Credit Loss (ECCL) data file, which provides five-dimension (economic scenario, loan type, vintage, state, and FICO) prepayment and credit loss assumptions through econometric models based on Equifax industry performance data. Edge uses the Probability of Default and Loss Given Default assumptions in the ECCL file for all covered loan types, and the prepayment assumptions for all covered loan types except residential mortgages. For residential mortgages, Edge uses the prepayment model developed by ZM Financial Services (ZMFS), whose ALM system and models are widely used by over 2,000 banks and credit unions. ZMFS was acquired by Moody’s Corporation in December 2020 and is now a part of Moody’s Analytics. Edge Analytics includes Moody’s Analytics data for our subscribers. For the few loan types not covered by Moody’s ECCL data file, Edge uses static prepayment and credit loss assumptions based on historical performance data published by the Federal Reserve, relevant publications, and market research. |

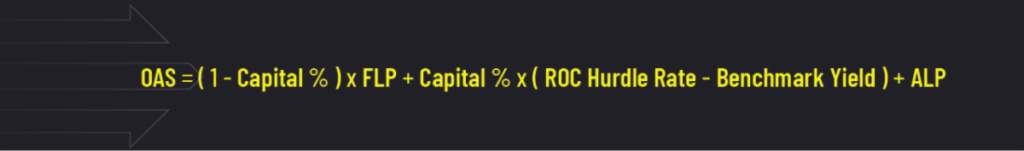

Edge uses the same discounted cash flow approach and OAS/prepayment/credit loss assumptions above for calculating CECL except for the differences outlined below. For more information on OAS calculations, visit our post on Loan Pricing here.

- Edge CECL calculation only discounts the cash flows related to credit loss, i.e., default amount and recovery

- Edge CECL calculation only considers a single interest rate path. Forward interest rates are implied by the current yield curve. For CECL, we do not consider all interest rate paths generated by a Monte Carlo simulation.

Besides the discounted cash flow approach, Edge also provides several other approaches for calculating CECL, including using an institution’s own historical loan prepayment and credit performance data. Talk to your Edge representative for help in creating a more custom CECL calculation.

Are you taking advantage of Edge Tradeworks’ loan pricing and analytics tools?