Edge Tradeworks uses an Option-Adjusted Spread (OAS) discounted cash flow approach to calculate loan prices. The OAS approach is superior to traditional approaches that use yield or static spread (Z-spread).

Traditional pricing approaches only use one interest rate path for discounting an instrument’s projected cash flows into present value (price). This interest rate path typically consists of forward rates implied by the current yield curve.

In contrast, the OAS approach generates multiple interest rate paths using a Monte Carlo simulation, calculates the present value of the projected cash flows on each interest rate path, and then derives the price of the instrument by averaging the present values overall interest rate paths.

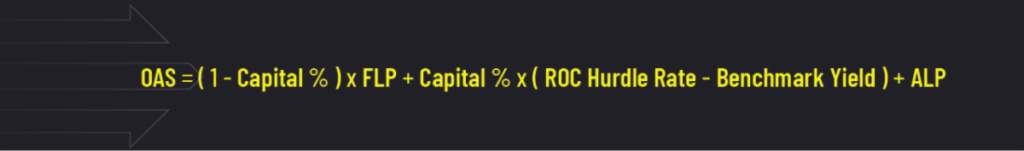

The OAS approach is dynamic and accounts for price impacts from both explicit and implicit options. OAS is the spread added to the benchmark yield curve that is used to discount the cash flows of an instrument over its life.

The OAS-based price is a probability-weighted price that accounts for the cash flow uncertainty resulting from interest rate volatility. The OAS approach is especially important for pricing mortgage loans or mortgage-backed securities since in the US the mortgage borrower usually has a free option to prepay the mortgage at any time. The prepayment probability is highly dependent on interest rates. When interest rates decrease, the borrower will be more likely to prepay and refinance the mortgage in order to reduce the interest expense, and vice versa.

The OAS of a loan or security can be interpreted as its “expected outperformance” above the benchmark yield curve, assuming the yield curve and the cash flows behave consistently with the pricing models. For a loan or security without explicit or implied interest rate options, OAS is the same as Z-spread and the OAS approach is the same as the Z-spread approach.