What is Loan Participation?

Participations are legal and financial arrangements used to reduce or gain exposure to chosen market segments.

Participations are often on larger portfolios or pools of loans, say a $100mm pool of auto loans. In this case, the seller of the participation sells a percentage interest in the entire pool. For example, a CU may sell a 90% participation to one or more buyers. If one buyer wants to invest $90mm in the participation of this auto pool, they would be buying 90% of the economic performance of the entire $100mm pool (assuming the participation was priced at 100). The seller of the participation continues to service the entire $100mm pool, but passes 90% of the economic performance and 90% of the risk of the entire pool of loans onto the buyer. The buyer receives 90% of the total pool P&I payments and also assumes 90% of any defaults.

A loan participation is also an arrangement, in essence a syndication, in which multiple lenders, often financial institutions like banks, credit unions, or other lending organizations, collectively fund a single loan to a borrower. This lending model is primarily used for larger loans or when lenders want to spread the risk associated with a single borrower over multiple parties.

Participations are legal and financial arrangements used to reduce or gain exposure to chosen market segments.

Pros of Loan Participation:

Loan participation allows credit unions to effectively manage risk, enhance returns, diversify their portfolios, and maintain regulatory compliance. It also provides flexibility in liquidity management and strengthens member relationships. By participating in loans, credit unions can achieve a balance between serving their members’ needs and managing financial stability and growth.

On the opposite side, participations allow the buyer of the participation to gain exposure to segments where they may not have underwriting capacity or expertise.

Cons of Loan Participation:

Some of the drawbacks of loan participations, include complexity, regulatory scrutiny, and may have issues with agreement terms. The process for setting up loan participations differs for buyers and sellers, involving policy creation, due diligence, and negotiations. Costs are incurred by both parties, including staff time, training, and consulting fees. Loan participations require ongoing attention and communication with the lead bank, making them a complex investment that demands careful management.

How do you know you need to engage in Loan Participation?

Step 1: Determine your liquidity status. As an example, your loan-to-share ratio is very high.

Step 2: Adjust your loan portfolio by participating loans out to another counterparty.

Edge Tradeworks can take away concerns

Edge Tradeworks is a valuable platform that can address the drawbacks associated with loan participations in the following ways:

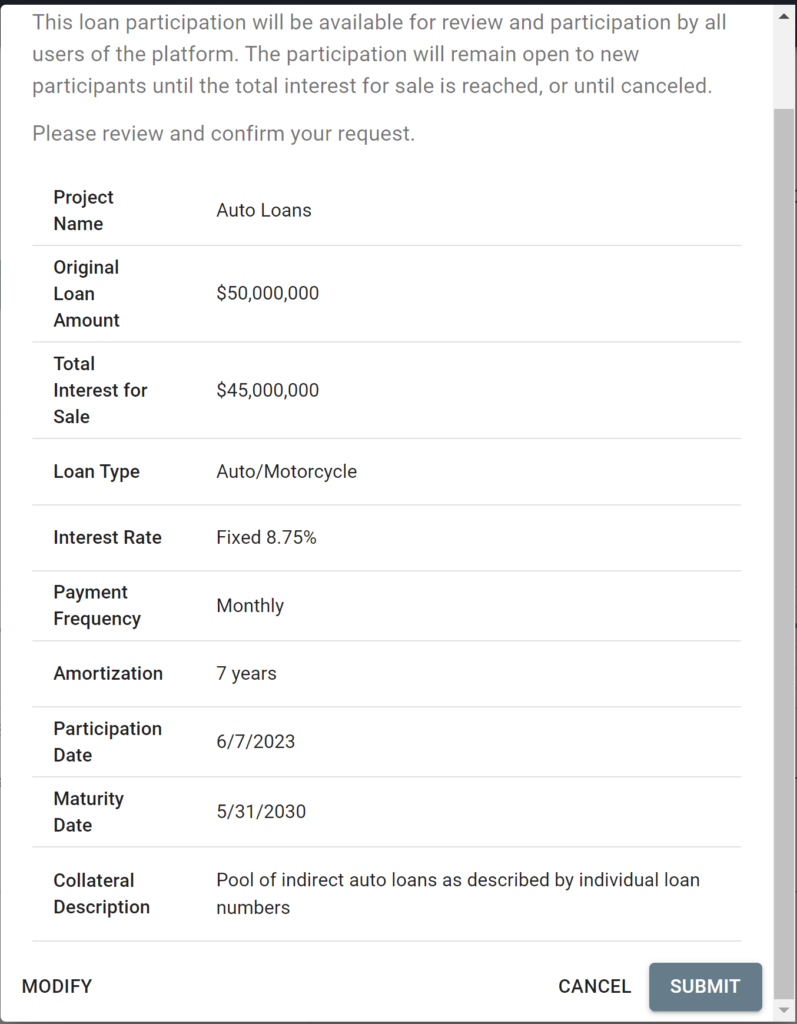

- Efficient Counterparty Matching: Edge utilizes intelligent algorithms that consider factors like loan inventory, regulatory insights, balance sheet profiles, and trend analysis to efficiently match relevant buyers and sellers . This reduces the complexity of finding suitable counterparties and ensures smoother trade execution.

- Comprehensive Loan Analytics: Edge provides in-depth loan analytics and pricing information for every loan or loan tape. It calculates a Reference Price as a starting point for price negotiation, allowing users to define assumptions and scenarios. This transparent analysis helps participants make informed decisions about loan participations and reduces the risk associated with unclear terms.

- Electronic Price Negotiation: Participants negotiate directly with one another with no middleman. This facilitates direct communication and file sharing, making it easier to reach mutually agreeable terms. Trade confirmations are generated and signed via secure DocuSign, providing a permanent record of the entire trade workflow for added security and transparency.

- Custom Peer Analysis: Edge enables instant peer and performance analysis, including Return on Capital Peer Attribution Analysis and C-A-M-E-L analytics with custom peer comparison. This feature assists institutions in assessing the risk and performance of potential loan participations, reducing the complexity of due diligence.

- Efficiency, Liquidity, and Transparency: Edge Tradeworks offers several advantages, including quick access to the ALM profile of every US bank and credit union, robust loan analytics, and balance sheet management capabilities. The platform streamlines the trade workflow through a user-friendly interface, ensuring efficient and transparent participation in loan markets.

- Improved Liquidity: Edge’s smart matching capabilities facilitate transactions with one seller and multiple buyers, making loan participations more cost-effective and enhancing liquidity. This benefit can mitigate the risk associated with holding illiquid loans.

Schedule a short tour of our platform and see how you can engage in Loan Participation.